A trusted logistics partner should take the utmost care in delivering your goods for you, and make sure your shipments enjoy hassle-free customs clearance anywhere in the world. Customs clearance doesn’t have to be complex.

A few simple steps can get your international shipments where they need to go, on time and every time. It’s exciting to be able to trade almost anywhere in the world these days. But no matter where your customers are, they expect their purchase to arrive on time and in perfect condition.

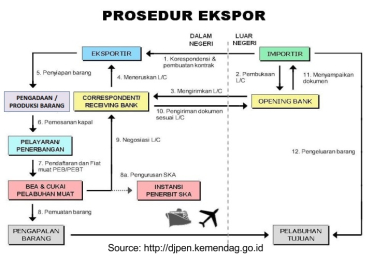

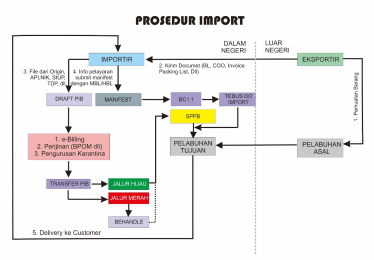

Step 1 - Complete your documentation

As the exporter, you’re responsible for preparing all the customs documentation needed for your international shipment. You can submit your trade documents electronically ahead of time to get a head start on the clearance process.

Step 2 - Customs Brokerage

PT CSC automatically include customs brokerage. We offer standard customs clearance, however, we also offer a comprehensive range of value-added solutions when your shipment has special clearance needs.

Step 3 - Duties and Taxes

Most shipments across international borders are subject to duty and tax assessment by the importing country. Customs authorities collect duties and taxes on goods coming into and out of a country as a type of tax on cross-border goods.

Common duties include tariffs on import goods that compete with locally produced items to protect local industries. Duties are usually paid by the exporter.

Common taxes include sales tax, value-added tax (VAT) and goods and services tax (GST) and are usually paid by the importer.

Step 4 - Regulatory Alerts

International shipping regulations and requirements can change quickly. Contact us for a great way to be alerted about the latest news that may impact your shipments and stay updated with special offers.

Here’s a snapshot of the customs and regulation requirements you will need to know when sending a package internationally.